Investment Philosophy

An extremely simple investment process

Home / Investment Philosophy

INVESTMENT PHILOSOPHY

We seek to deliver consistent returns over the medium term given a predefined amount of risk, by implementing management techniques that differ from traditional fixed income mutual funds.

We collect views and trade ideas from research platforms of major investment banks and specialised market participants.

When compared to traditional mutual funds, we have access to a much broader universe of fixed income instruments and take advantage of this access in the selection and implementation of the views in the portfolio context.

We use agile and active management style. We apply this on both a macro and on a micro level.

We aim to avoid single views dominating the overall performance of the fund.

We use quantitative and qualitative risk management techniques to minimise drawdown risk in the fund.

We are not traditional long only managers.

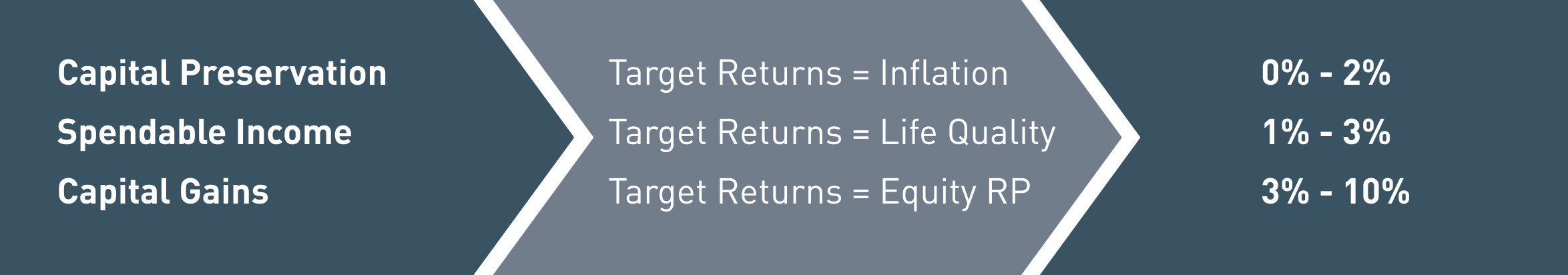

Historically, the below target returns are associated with the above strategic objectives:

All of our bond portfolios prioritise capital preservation and the achievement of spendable income over capital gains.

Because Patient Capital gets you there.

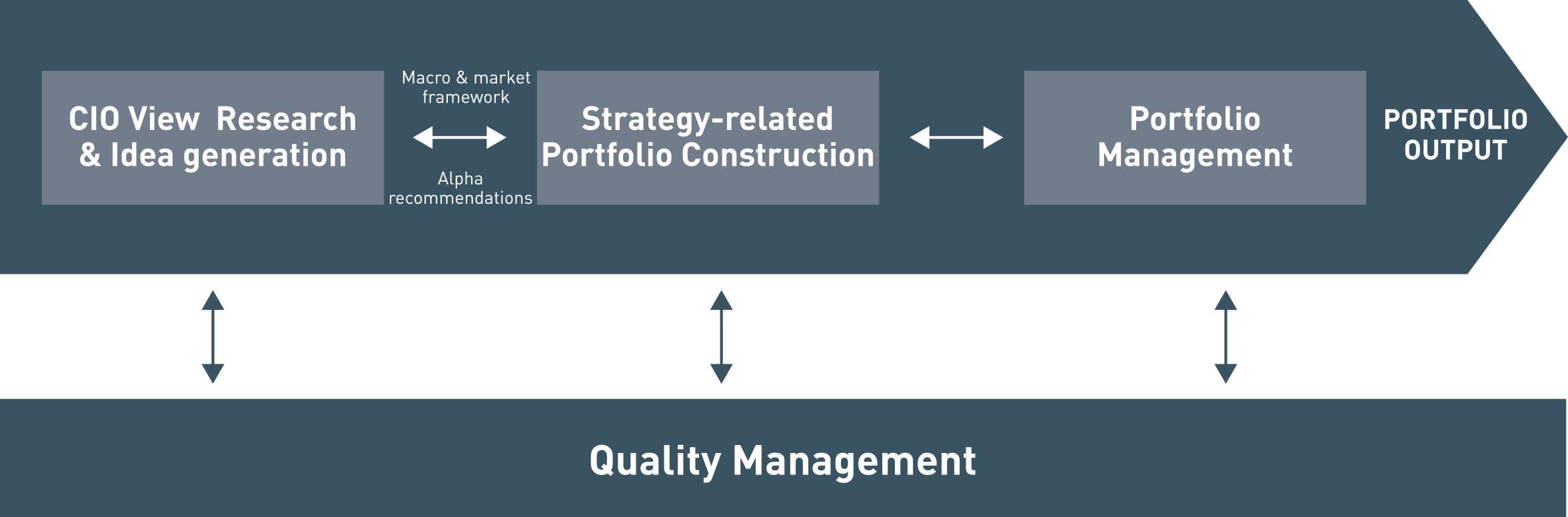

INVESTMENT PROCESS:

Relying on solid building blocks

Our process seeks to deliver consistently superior returns; conviction and accountability are the focus at each step of the process.

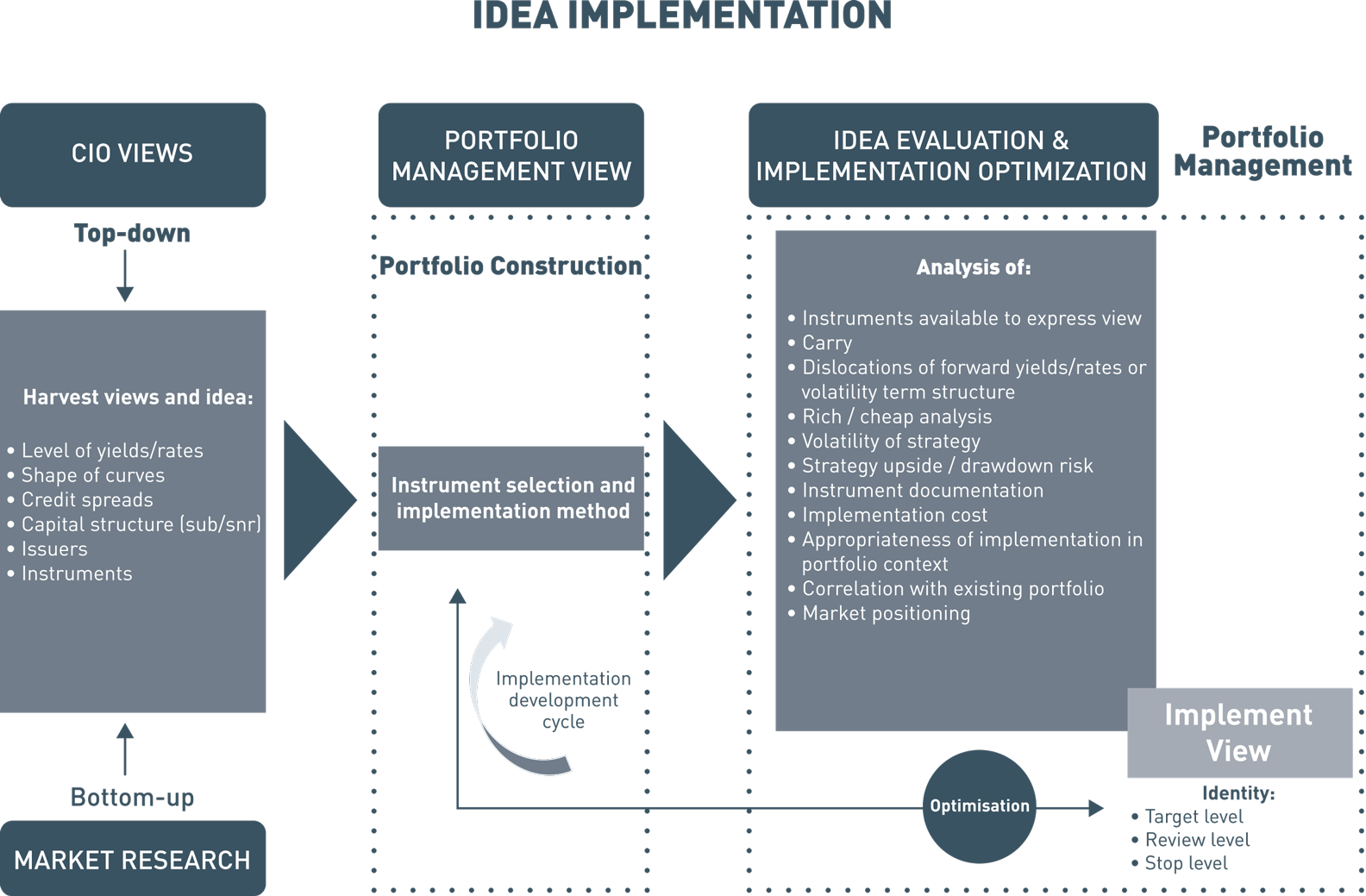

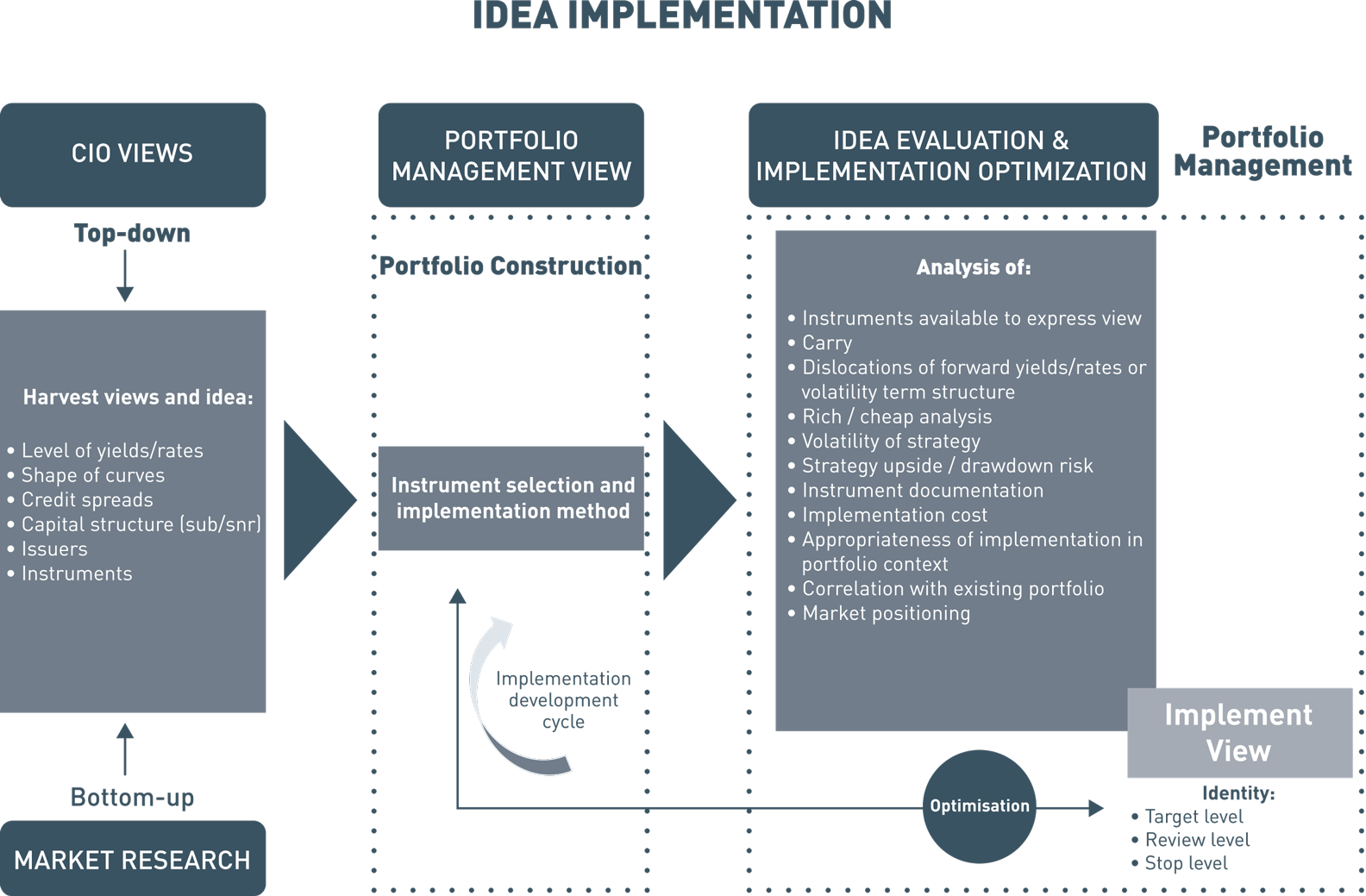

Investment Process: Idea Implementation

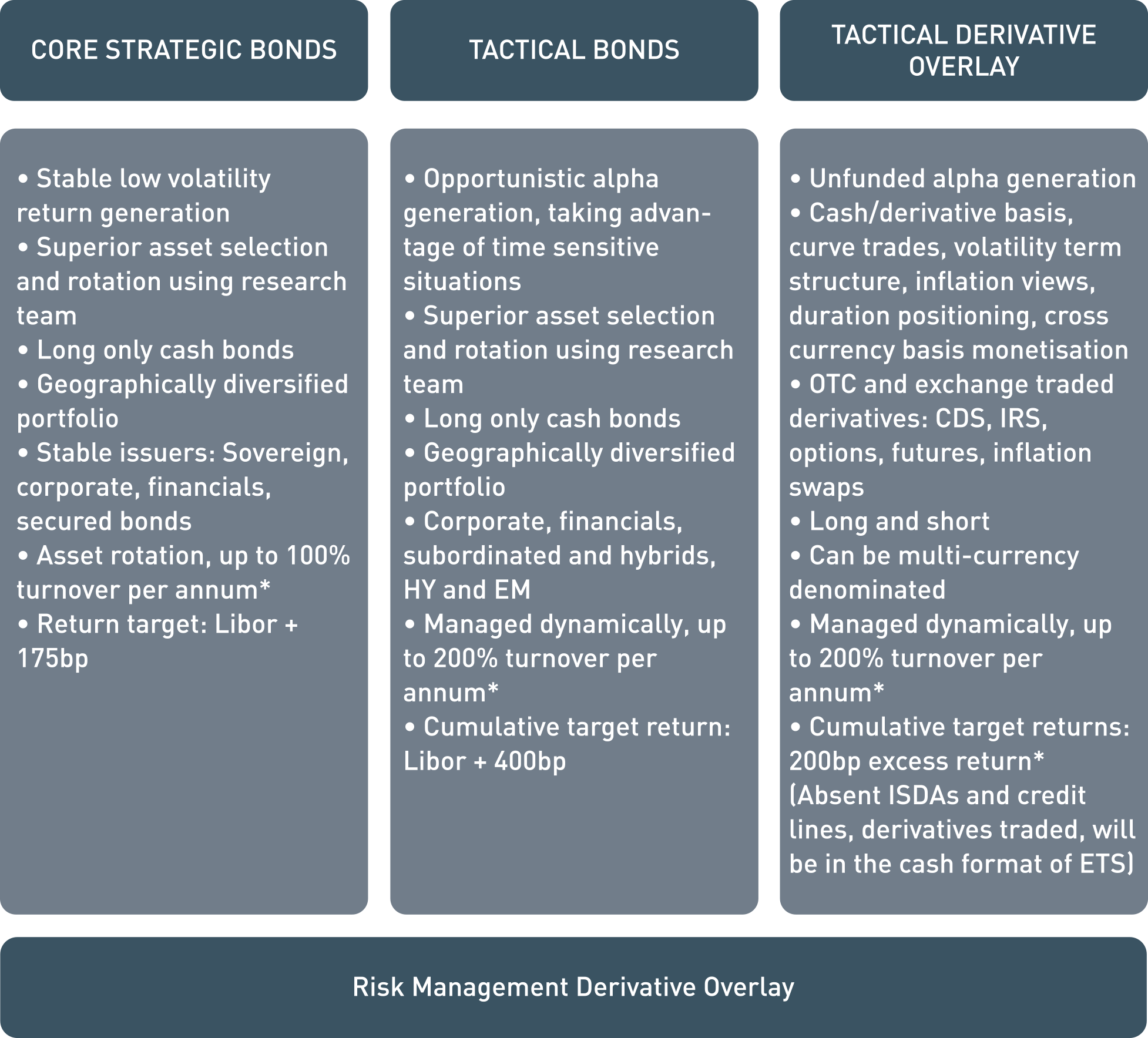

Portfolio Construction: Allocation of Investment Pillars

Building blocks used to generate core returns, additional alpha and risk management

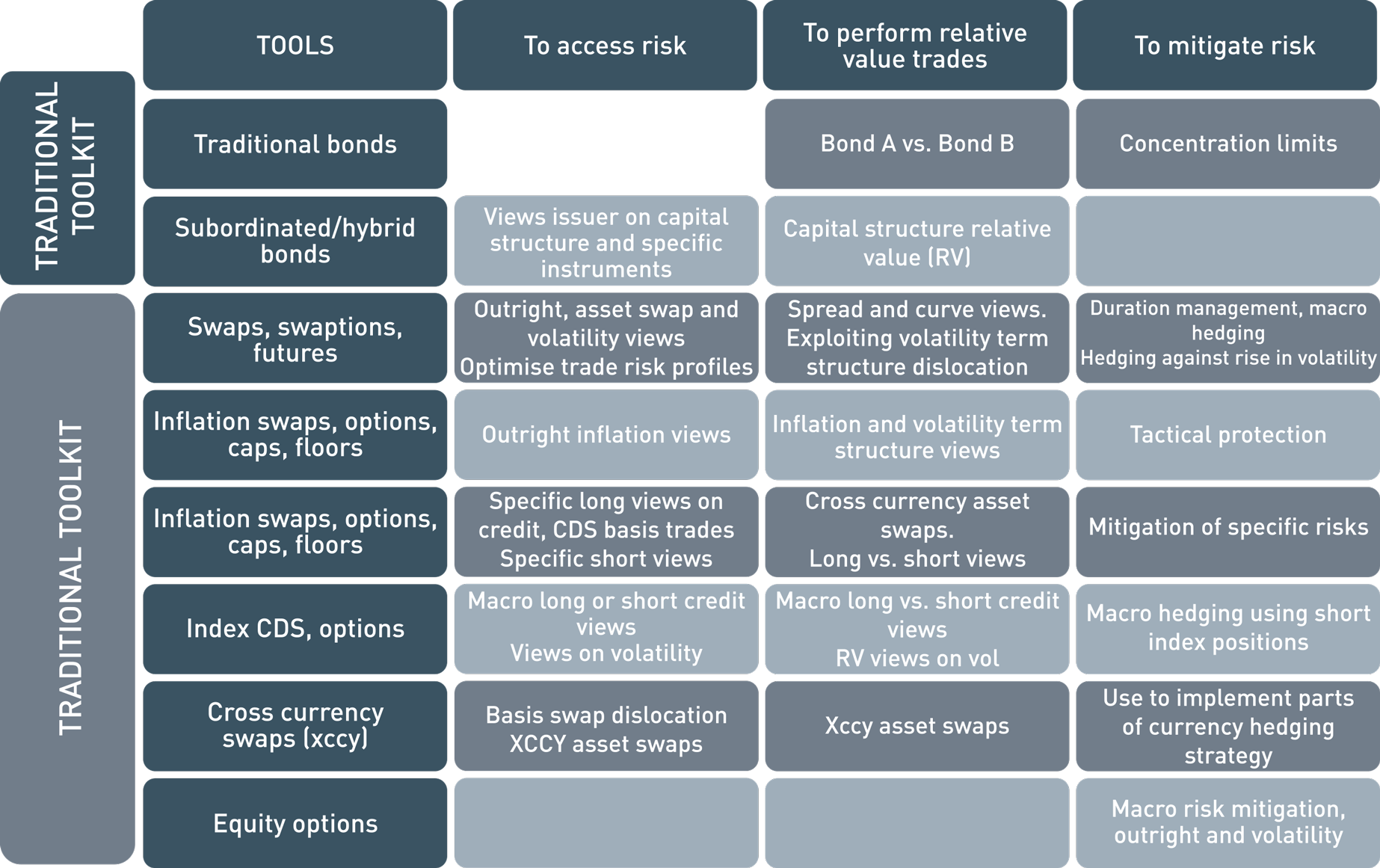

Portfolio Construction: Trading Instruments & Techniques

Research and CIO View – Platform Overview

IDEA IMPLEMENTATION

PORTFOLIO CONSTRUCTION:

INVESTMENT PILLARS

ALLOCATION OF INVESTMENT PILLARS

Building blocks used to generate core returns, additional alpha and risk management

Portfolio Management:

Broad Trading Instruments and Techniques (Extended Toolkit)

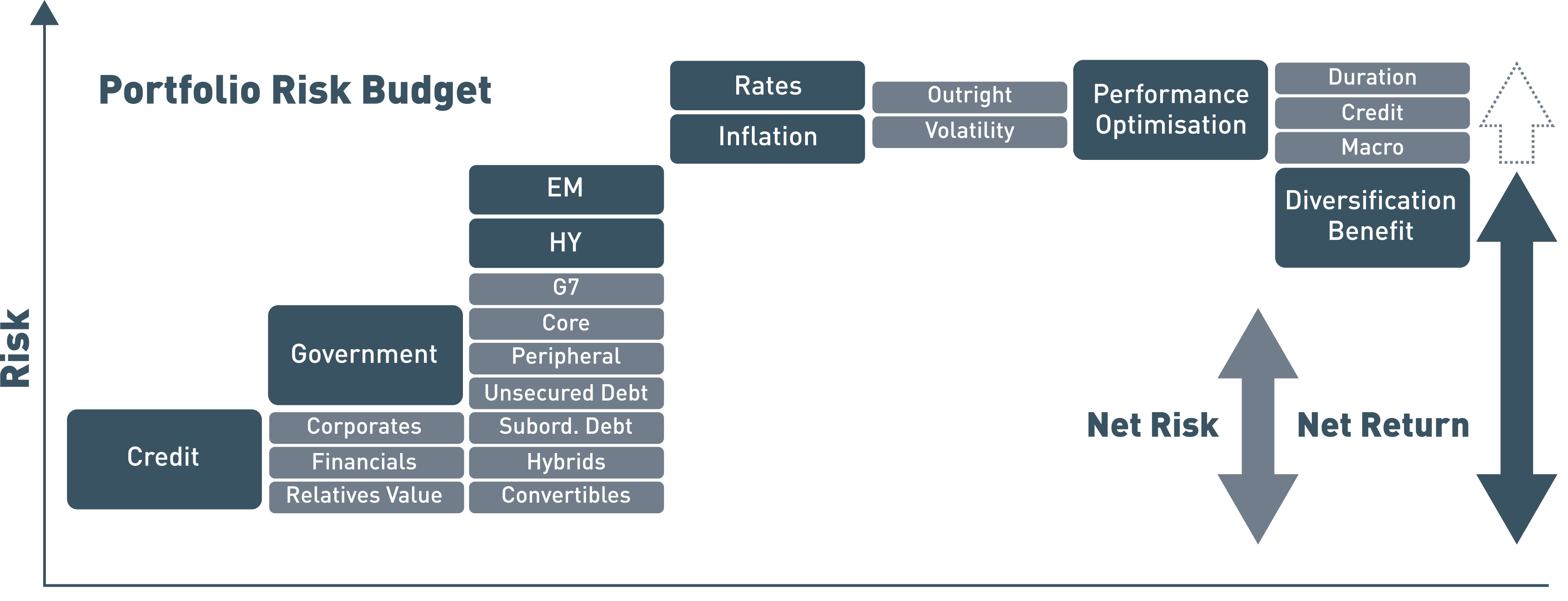

RISK MANAGEMENT:

PORTFOLIO LEVEL

Active risk management using comprehensive tools

to analyse and manage risks in the portfolio:

- Stress tests: detailed NAV impact from rate and spread movements

- Scenario analysis: potential impact to the portfolio from an unexpected shock event

- Active risk mitigation through quantitative portfolio construction and derivatives

- Macro and specific risks managed : duration, credit, currency and use of equity as proxy where appropriate

- Target annualised volatility up to 5% and a VAR limit (99th percentile, 1 day) limit of 4%

Position level

- Active risk management of every fund position

- Quantitative risk analysis for correlations between trades across the portfolio and exposure to changes in those correlations

- Strict review levels for every position. Stop loss levels

- Frequent reassessment of every single position in the portfolio to validate its risk/reward

- Performance attribution reports to assess contribution to daily NAVs of rates, FX, credit spreads and duration

- Capital at risk analysis to size every position

WAP Fixed Income Strategy:

Investment Profile

Performance Objective:Benchmark + 300 - 500bps*

Instruments:Global fixed income universe (cash and synthetic) including convertibles, exchange traded futures and OTC derivatives

Leverage:Allowed

Risk Limits: 2% - 5% annualised volatility; VAR (99th percentile, 1 day) limit of 4%

Credit Rating: External or investment bank shadow rating no lower than B-**

Duration: Range between +6 yrs to -4yrs

Derivatives: Allowed, primarily for hedging purposes

Single issuer limit: Not more than 10% of the portfolio should be held in securities from a single issuer.*** In order to ensure diversification, the positions are generally smaller

* No assurance can be given that investment objectives will be achieved

** Internal or investment bank shadow ratings

*** Unless sovereign, supranational, regional government or covered bonds